Death is an inevitable part of life.

Almost all of us, at some point in our lives, will experience loss. Generally, this is not a subject we want to think about, or talk about.

Bereavement can prove to be one of the most painful experiences that we endure. Everyone grieves in different ways. The feeling of being overwhelmed by grief and not knowing what to do, who to turn to, can be the most difficult time and we may all find ourselves in this position at some point in our lives.

I hope you will find this article a useful guide to help you through the initial steps following bereavement.

When you think about the practicalities following the death of a person, particularly a loved one, it can be overwhelming. If you feel unsure of what to do, then you will need some help and direction of where to begin.

Here is a ‘Step-by-Step’ guide to help you navigate this difficult process.

Step 1 Obtain a Medical Certificate

Either the GP or hospital will issue a Medical Certificate of Cause of Death.

What you need to do will depend on the circumstances of the death, whether the person died suddenly or following a long illness, or if they died at home or in hospital, the initial steps are relatively the same.

The exception will be if the cause of death is unknown as a Coroner may call for a post mortem examination which will delay next steps.

Step 2 Register the death

Take the Medical Certificate with you to register the death. Deaths must be registered with the local registrar as soon as possible, usually within 5 days of the death. It is advisable to obtain a few Death Certificates as these will be needed when sorting out the deceased’s estate.

Register the death with the Government’s Tell Us Once service. This service can be used to report the death to government departments in one go, such as Department for Work & Pensions, UK Passport Agency, HM Revenue and Customs and local authorities including the Council Tax office.

Step 3 Arrange the Funeral

Make the necessary funeral arrangements according to any specific wishes that the deceased may have expressed in a Will, or a letter of wishes.

Step 4 Contact legal services

If the deceased made a Will, then inform the relevant solicitor/legal representative. The Personal Representatives (‘PRs’) named in a Will have legal responsibility to deal with the affairs of the deceased. Provision for guardianship of children, or any dependents who cannot take care of themselves, including pets for example, may need to be dealt urgently. If a Will is not located, and there are dependents to be considered, then arrangements need to be made immediately.

Step 5 Secure assets

Notify the house insurance provider (the ‘PRs’ interest should be noted on the policy). The deceased’s residential home is generally the main asset of an estate.

Ensure the deceased’s personal property is safeguarded by locking the house and any other property including vehicles. Remove valuable items from an unoccupied property. Establish key holders.

Step 6 Dealing with the deceased’s financial affairs

Establish who is responsible for dealing with the deceased’s affairs. This depends on whether there is a Will or not.

It is advisable PRs seek legal advice to determine the need for a Grant of Representation (A Grant of Probate where the deceased left a Will, a Grant of Letters of Administration where the deceased died without having made a valid Will).

‘Probate’ is the process of a Court validating the deceased’s Will to enable the assets of the estate to be distributed. The administration of an estate can be a lengthy process. There will be financial dealings throughout the administration period that need to be taken care of. Once all assets are gathered in and all debts and taxes have been settled then distributions can be made to beneficiaries as outlined in the Will (or, if there is no Will, as outlined by intestacy rules).

Dealing with the affairs of a deceased person can be a long and complicated process.

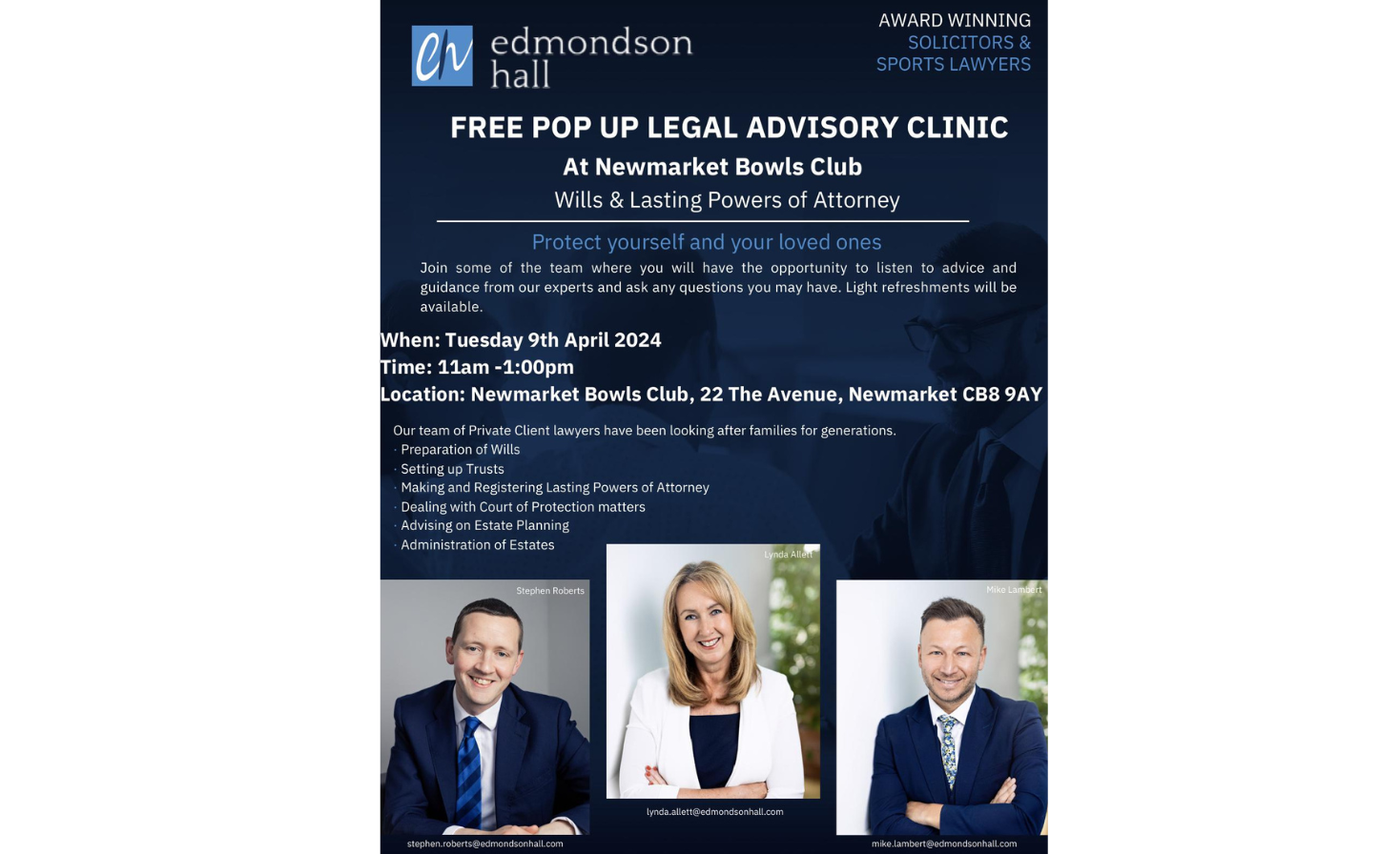

Edmondson Hall’s Private Client lawyers are here to help, providing sound advice and assistance for all estate planning needs, including Will writing, Grant of Representation applications and Administration of Estates. If you would like to discuss any Private Client related matter please get in touch with us by telephone on 01638 560556 or email below;

stephen.roberts@edmondsonhall.com